Judge overseeing an X Corp. lawsuit has an Elon Musk-entangled investment history

Although Judge Reed O'Connor's Tesla stocks were in the news in August, his investments in recent years circle around Musk more than previously reported.

This past week, U.S. District Judge Reed O’Connor issued a ruling that had the result of keeping a lawsuit that Elon Musk’s X Corp. brought against Media Matters alive and in his court.

The August 29 ruling in X Corp’s lawsuit over Media Matters’s critical coverage of X Corp., formerly known as Twitter, was unexpected given a prior decision from the court above him, the U.S. Court of Appeals for the Fifth Circuit. O’Connor’s ruling seemed to be seeking a way around that decision in order to keep the case alive.

Beyond any questions about the merits of his ruling, however, are more fundamental questions about the propriety of O’Connor issuing the ruling at all due to his extensive financial entanglements. A Law Dork review of O’Connor’s available financial disclosure reports shows three potential areas of concern that are raised by O’Connor sitting on the X Corp. case.

Under the federal recusal statute, O’Connor “shall” recuse himself from any proceeding in which “[h]e knows that he … has a financial interest in the subject matter in controversy or in a party to the proceeding, or any other interest that could be substantially affected by the outcome of the proceeding.” Beyond that, he also is to recuse himself “in any proceeding in which his impartiality might reasonably be questioned.”

O’Connor’s continued assignment to X Corp.’s lawsuit, though, highlights how complicated accountability is within the federal judicial system.

Identifying potential conflicts is difficult due to the lack of transparency that remains in the system, and individual stock ownership and similar investments raise questions beyond conflicts that nonetheless reflect on a judge’s actions. Additionally, questioning potential conflicts is risky for lawyers who have to practice before any given judge — and dealing with the refusal of a judge to recuse is rife with even further danger.

O’Connor, a George W. Bush appointee, is one of two far-right judges in the Northern District of Texas who are the sole judge assigned cases filed in one of the divisions of that district. Under rules set by the Northern District of Texas, O’Connor hears 100% of the cases filed in the Wichita Falls division. He also splits the cases filed in the Fort Worth division with two other judges, one of whom is senior status and only takes 10% of the cases filed there.

O’Connor also has an unusually large portfolio of investments, listing more than 200 individual investments — including stock from well over 100 companies — during 2022, according to his financial disclosure report covering that year.

The holdings likely already led to his recusal in an advertising-related lawsuit brought by X Corp. this year. There, Unilever PLC, in which O’Connor had investments as of his 2022 report, was a named defendant. In another high-profile case, where the U.S. Chamber of Commerce is challenging the Consumer Financial Protection Bureau’s credit card late fee rule, O’Connor also recused — likely due to his investments in the credit card companies, which was highlighted by Accountable.US prior to his recusing in the case. (That case ended up before U.S. District Judge Mark Pittman, a Trump appointee who nonetheless has sparred with the U.S. Court of Appeals for the Fifth Circuit in the case over judicial assignment questions.)

At the same time, questions about his investments have not led to his recusal in a similar advertising case brought by Rumble — or in the Media Matters case. In fact, X Corp. v. Media Matters was initially assigned to Pittman. In that case, Pittman was the one who recused himself from the case, leading to its reassignment to O’Connor.

What we know of O’Connor’s finances, though, show at least three potential financial connections between O’Connor and Musk in recent years.

And yet, he remains on the case.

Following last week’s ruling, X Corp. filed a motion the next day seeking to compel Media Matters to turn over non-public information about its donors. O’Connor nearly immediately set a one-week deadline for Media Matters to respond.

The Tesla stock fight

Last month, NPR’s Bobby Allyn reported that O’Connor owned Tesla stock, according to his latest financial disclosure report. According to the filing, O’Connor invested in Musk’s Tesla in late 2022 — initially within a month of Musk acquiring Twitter, which Musk later renamed X. By the end of the year, O’Connor owned between $15,001 and $50,000 in Tesla stock.

Media Matters’s lawyers raised this issue, seeking an order that X Corp. file a corrected “certificate of interested persons” that included Tesla.

What’s that? Under the Northern District of Texas’s local rules (3.1), the certificate is to include “a complete list of all persons, associations of persons, firms, partnerships, corporations, guarantors, insurers, affiliates, parent or subsidiary corporations, or other legal entities that are financially interested in the outcome of the case.“

In the June request, Media Matters’s lawyers argued, “Musk has so thoroughly blurred the lines between his private interests, Tesla’s corporate interests, and X’s interests that benefits to X can be imputed directly to Musk and Tesla. The market, certainly, has shown that it will treat them as one and the same.”

O’Connor rejected that request a week after the August NPR report ran. As he acknowledged in ruling, “Local Rule 3.1(c) operates as an additional disclosure requirement to the Court to help ‘determine whether recusal is required.’” However, he quickly noted that he was “concerned” by Media Matters’s timing in filing the request, which he then rejected:

That wasn’t all, though.

Crystalizing the difficulties that litigators face when faced with potential conflicts, O’Connor went on to award attorney’s fees to X Corp. for the matter, concluding that Media Matters’s motion was “not substantially justified.” Specifically, he wrote that “it appears Defendants seek to force a backdoor recusal through their Motion to Compel. Gamesmanship of this sort is inappropriate and contrary to the rules of the Northern District of Texas.”

O’Connor’s other investments

The Tesla stock ownership is not O’Connor’s only investment activity that potentially has a connection to Musk.

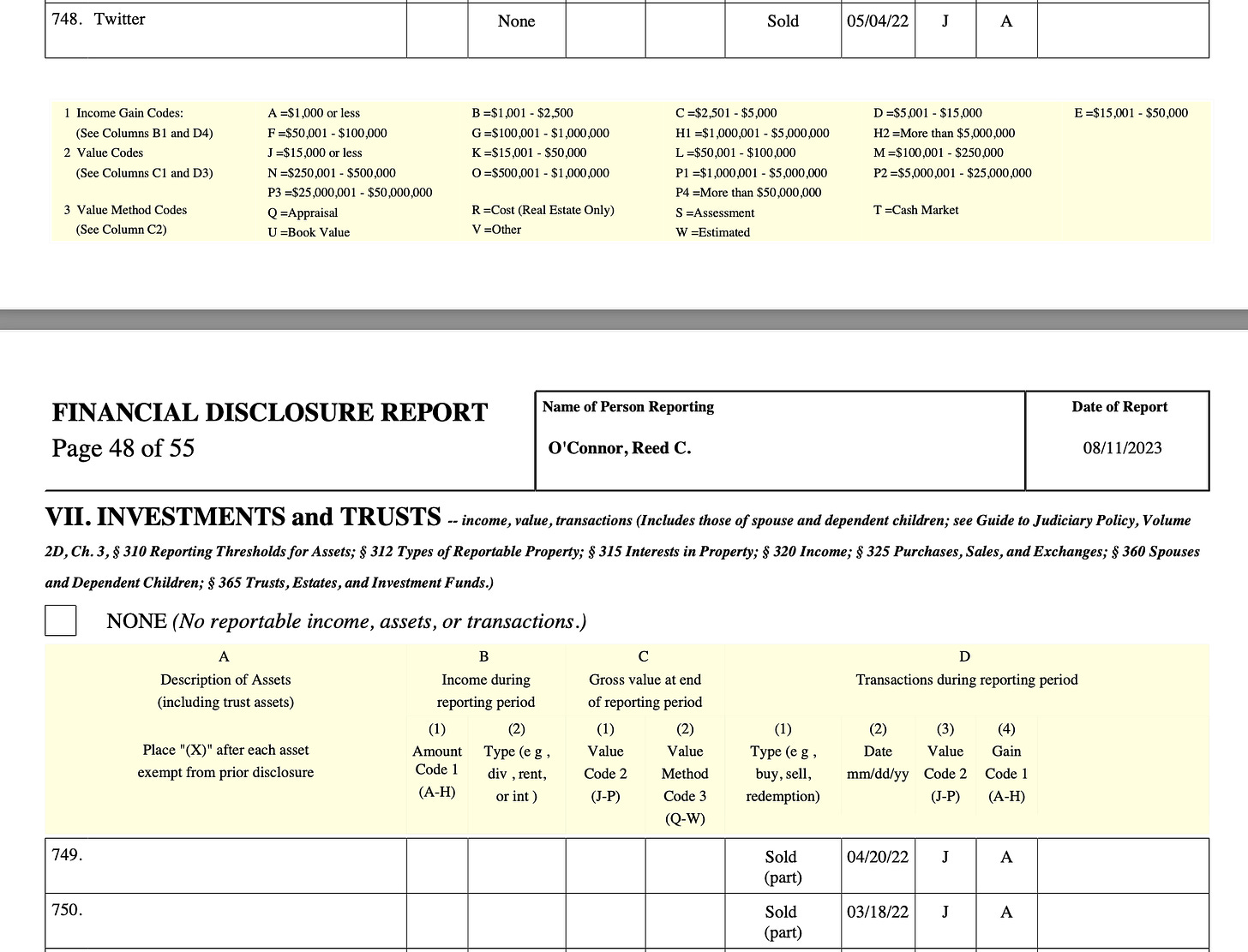

Earlier in 2022, as Musk underwent his effort to purchase Twitter, O’Connor began selling off small amounts of Twitter stock that he had owned since at least 2021.

O’Connor sold the last of his Twitter stock as Musk was publicly discussing his financing efforts to take the company private — and the effect that would have on shareholders.

Although this sale coming prior to the filing of the case would mean this doesn’t create a conflict, it nonetheless reflects on how closely O’Connor does appear to have followed Musk and his financial dealings long before being assigned any of these cases — and how regularly intertwined they were with his personal financial decisions.

That isn’t it, though. O’Connor was also investing small amounts in a third entity that has a longstanding relationship with Musk, Brookfield Asset Management.

Like with the Twitter stock, O’Connor apparently had some investments in Brookfield Asset Management and Brookfield Corp. Class A since at least 2021, per his 2022 report.

During 2022, O’Connor bought and sold Brookfield Asset Management Ltd. and bought additional Brookfield Corp. Class A shares — still holding investments in both at the end of 2022.

From that, it is clear that he continued to hold some of that investment after Musk announced in a securities filing that he secured additional funding for his Twitter purchase that included Brookfield. As the managing partner of Brookfield Asset Management’s Brookfield Growth fund wrote on LinkedIn at the time, as reported by Bloomberg, “We are thrilled we can once again support Elon and his mission of transforming the future through innovative and world class technologies.“ The Bloomberg report detailed an ongoing relationship between Brookfield and Musk, including a 2021 “sustainable neighborhood” announcement involving both.

Fast-forward to this year, and an August 20 order in another case involving X Corp. — prompted by a request from Jacob Silverman — led to the disclosure of an unredacted list of the owners and shareholders of X Corp. as of June. Among the companies listed is Brookfield Project X L.P.

Because it is not clear how Brookfield Project X L.P. was funded, it is not clear whether O’Connor’s investments would even possibly be directly invested in X Corp.

If O’Connor is still invested in Brookfield Asset Management, though, it would mean, at the least, that O’Connor is invested in a company that has a fund invested in X Corp. and has a longstanding relationship with Musk.

Disclosure difficulties

We don’t know whether O’Connor still invests in Brookfield Asset Management — but that lack of clarity only raises more questions.

Right now, none of O’Connor’s annual financial disclosure reports are available on the Federal Judicial Financial Disclosure Reports database operated by the Administrative Office of the U.S. Courts. At some point earlier this summer, they were pulled from the site — but they’re expected to be back online soon.

If that sounds messy, that’s because it is.

The reports are posted online under the Courthouse Ethics and Transparency Act of 2022, which amended the Ethics in Government Act of 1978 to increase the disclosure requirements for federal judges and made disclosure reports far more accessible to the public. However, as discussed in an earlier report at Law Dork, the system is still relatively new and has its issues, including there being a backlog of reports to be posted.

Of the removal of O’Connor’s reports, Law Dork was earlier told via email from staff at the financial disclosure office, “When adjustments need to be or potentially need to be made to reports, they are pulled from the website.“ After any changes are submitted and reviewed, they are posted online again.

In other words, we now get judges’ financial disclosures posted online, but there’s a backlog to get them posted, they can be pulled off-line at any time with no explanation, and changes apparently can be made with the public not having any real way to know that such changes have been made.

Complicating things further for understanding O’Connor’s investments, his 2023 financial disclosure report is yet to be publicly posted — but that, again, could be a function of delays and the backlog in the system.1

In addition to the annual reports, there are no periodic transaction reports currently posted for O’Connor. Periodic transaction reports detail any stock transaction valued at over $1,000 and are required to be submitted by judges within 45 days of the transaction, under the 1978 ethics law as amended by the 2022 judicial ethics law.

O’Connor would be expected to have many of them. He filed at least 10 such reports for 2023 — included in Media Matters’s June filing regarding the Tesla stock as evidence that he did not report any sale of Tesla stock in those 2023 periodic reports.2

To the extent those filings shine light on O’Connor’s continued Brookfield investments, there are no Brookfield sales (or purchases) listed on the 10 periodic reports for O’Connor included in Media Matters’s filing.

Since they were pulled, though, we don’t even know if those are accurate — let alone what sales he has made since.

Law Dork was told by staff in the financial disclosure office on Tuesday that O’Connor’s reports are expected to be back online next week.

Although, really, why is this system still not working in such a way that the public is actually informed about judicial disclosures in a timely manner?

Apparently we are way beyond that sissy concept that “No one’s above the law!” Apparently if you’re rich, right wing, Christian and white (or wholly bought by rich white Christians), you’re legit.

Ethics? Recusal? Responsibility? For pansies only. Only real men need apply.

As a good MAGA judge (following in the mold of Clarence, Samuel, and CJ John), there will be little reason for recusal here in his mind and in the minds to MAGA followers.